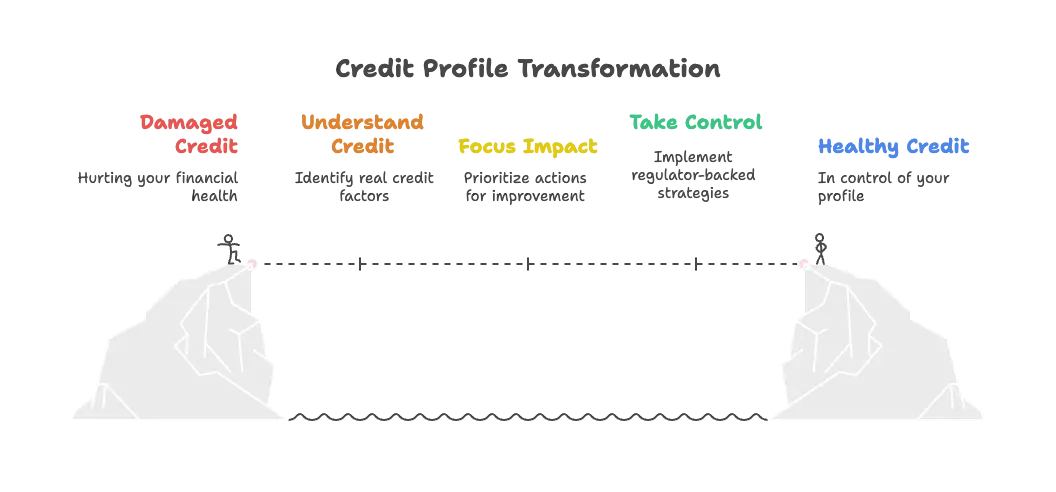

Bad credit doesn’t appear out of nowhere. It’s usually the result of a few repeat offenders: late payments, high credit card balances, errors on your credit reports, old collection accounts, or a thin credit history that never had a chance to prove itself. Despite what social media might suggest, there’s rarely a single “secret trick” behind a low score, just patterns, habits, and data.

That’s why fixing bad credit works best when it’s done in the right order. Chasing hacks, like opening random accounts, paying for questionable credit repair services, or obsessing over minor scoring fluctuations, often wastes time and money. Real progress comes from addressing the fundamentals lenders actually care about, one step at a time.

By the end of this guide, you’ll understand:

- What’s really hurting your credit (and what’s not)

- Where to focus first for the biggest impact

- How to take control of your credit profile with practical, regulator-backed steps, not hype

1. Pull All Three Credit Reports (Know What Lenders See)

Why credit reports matter more than scores at first

When your credit is in rough shape, your score is just the messenger. The real story lives inside your credit reports, the detailed records that show every account, balance, payment history, and negative mark lenders use to judge risk. If the data is wrong or incomplete, the score built on top of it will be wrong too.

Credit report vs. credit score (raw data vs. calculation)

Think of your credit report as a spreadsheet and your credit score as a formula applied to it.

- Credit report: Lists accounts, payment history, balances, limits, and public records.

- Credit score: A number calculated from that data using a scoring model (like FICO or VantageScore).

You don’t “fix” a score directly, you fix the report, and the score follows. Both the FTC and Experian stress that checking and understanding your reports is the true starting point of credit repair.

Where to get your reports for free

In the U.S., consumers are entitled to free credit reports from all three bureaus:

- Experian

- Equifax

- TransUnion

The official site to access them is AnnualCreditReport.com, authorized by federal law. Beyond the standard annual access, the bureaus currently provide free weekly online reports, making it easier than ever to stay on top of changes.

Curious how close you are to a 750 credit score?

Take the 2-minute quiz to see where you stand, what’s holding you back, and the exact steps to level up your credit faster.

How to review reports the right way

Pulling your reports isn’t enough, you need to read them with purpose.

Why downloading and saving PDFs matters

Always download and save a PDF copy of each report. This gives you:

- A permanent record to reference during disputes

- Exact account numbers, dates, and balances

- Proof if information mysteriously changes later

If you ever challenge an error, documentation is leverage.

What information readers should be looking for

As you review each report, scan for:

- Accounts you don’t recognize

- Late payments that don’t match your records

- Incorrect balances or credit limits

- Duplicate collections or outdated negative items

- Differences between bureaus (the same account can appear differently)

Even small errors can drag down your score just as much as legitimate negatives, another reason the FTC and Experian both emphasize starting here.

2. Dispute Credit Report Errors (The Non-Negotiable Fix)

Why errors are one of the fastest ways to improve bad credit

A credit score doesn’t care why something is negative, it only reacts to what’s reported. That’s why errors can hurt just as much as legitimate late payments or collections. The upside? When inaccurate information is corrected or removed, the improvement can be immediate. No waiting months for habits to “age.” No complicated strategies. Just clean data.

For anyone dealing with bad credit, disputing errors is one of the highest-ROI actions you can take. It’s not optional. It’s foundational.

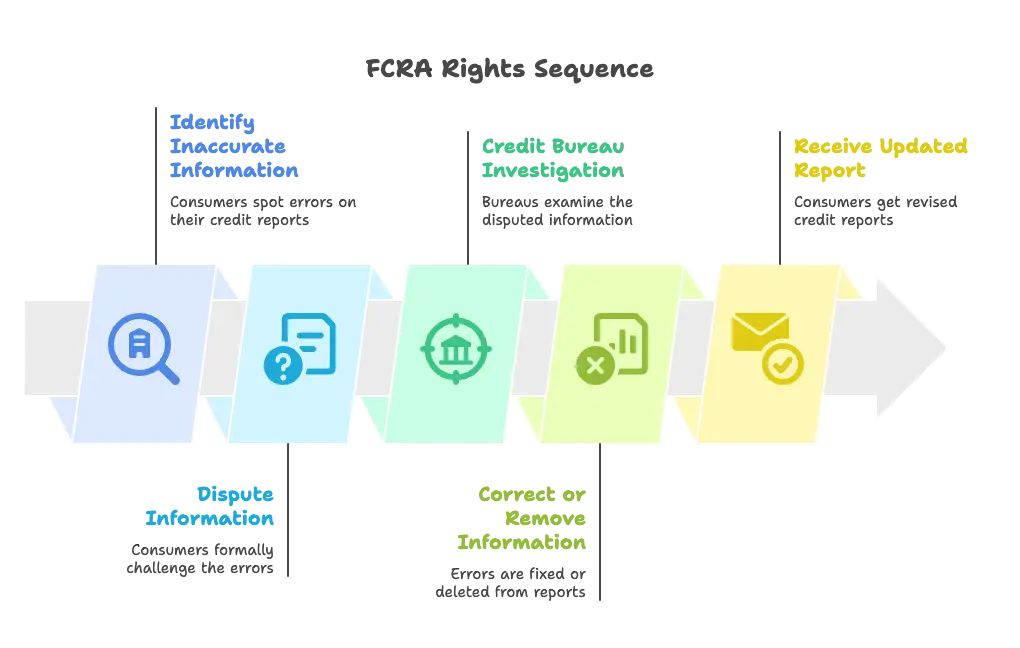

Your legal rights under the Fair Credit Reporting Act (FCRA)

Under the Fair Credit Reporting Act (FCRA), consumers have the right to:

- Dispute inaccurate or incomplete information on their credit reports

- Have credit bureaus investigate disputes, usually within 30 days

- See inaccurate or unverifiable information corrected or removed

- Receive updated copies of their reports after the investigation

Both the CFPB and the FTC make this clear: credit reporting accuracy isn’t a courtesy, it’s the law.

Common credit report errors to watch for

Credit report mistakes are more common than most people realize. As you review your reports, these are the big ones to flag:

Accounts that aren’t yours

These often come from mixed credit files or identity theft. You may see unfamiliar credit cards, loans, or collections that never belonged to you. Even one fraudulent account can significantly damage your score.

Incorrect late payments

A payment marked “late” when it wasn’t, or when it was brought current, can quietly drag down your credit for years. Date errors and status errors are especially common.

Duplicate or misreported collections

The same debt may appear multiple times, or a collection may show the wrong balance or date. Sometimes a debt is listed even after it was paid or settled.

If it’s wrong, incomplete, or misleading, it’s disputable.

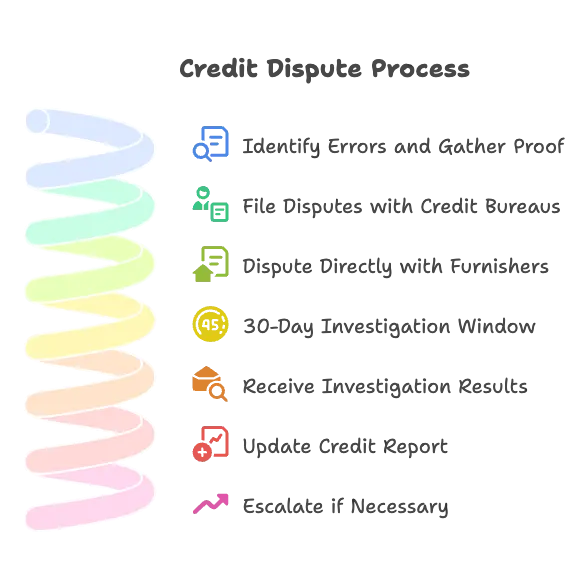

Step-by-step: How to dispute errors properly

Disputing works best when it’s done clearly, calmly, and with documentation. Here’s the clean process recommended by consumer regulators and legal experts.

1. Identify errors and gather proof

Mark the exact item you’re disputing on each report. Collect any supporting documents, statements, payment confirmations, correspondence, or identity theft reports. Never send originals; copies are enough.

2. File disputes with the credit bureaus

Submit disputes online or in writing to each bureau reporting the error. Clearly explain:

- What information is wrong

- Why it’s inaccurate

- What correction you’re requesting

Attach copies of your supporting documents. The FTC and CFPB both stress clarity over length, be specific, not emotional.

3. Dispute directly with furnishers

At the same time, send a similar dispute to the furnisher, the lender or collection agency that reported the information. This parallel step matters. Furnishers are legally required to investigate and respond when challenged directly.

The National Consumer Law Center (NCLC) strongly recommends this dual-track approach for stronger results.

4. What happens during the 30-day investigation window

Once a dispute is received, credit bureaus typically have 30 days to investigate. They’ll contact the furnisher to verify the information. If it can’t be verified or is found inaccurate, it must be corrected or removed.

After the investigation:

- You’ll receive the results in writing

- Your report will be updated if changes are made

- All bureaus that received the incorrect data must be notified

If the information remains, you can add a brief consumer statement, or escalate with additional documentation.

3. Get Current and Protect Payment History

Why payment history matters most

If credit scores had a backbone, payment history would be it. Across the major scoring models, nothing carries more influence. You can have low balances and plenty of available credit, but repeated late payments will still drag your score down. Lenders care less about perfection and more about reliability, and payment history is how they measure it.

Payment history’s weight in credit scoring models

According to myFICO, payment history makes up about 35% of a FICO Score, making it the single largest factor in most scoring models. It captures:

- Whether you pay on time

- How late payments are (30, 60, 90+ days)

- How often they occur

- How recent they are

Bankrate and CreditStrong both emphasize the same point: a single late payment can hurt, but a pattern of late payments is far more damaging.

How to stop the bleeding first

Before worrying about optimization, the priority is simple: prevent new damage.

Bringing accounts current

If any accounts are past due, getting them current should be your first move. Recent delinquencies hurt far more than older ones, and the scoring impact compounds the longer an account stays behind. Even bringing an account from 60 days late to current can make a measurable difference over time.

Why recent late payments hurt more

Scoring models heavily weight recency. A late payment from last month signals active risk; one from three years ago tells a different story. That’s why stopping new late payments immediately is often more powerful than trying to erase old ones.

Damage control strategies

Not every late payment is permanent, or untouchable.

Goodwill adjustment requests

If you’ve otherwise been a reliable customer, some lenders may remove a recent 30-day late payment as a one-time goodwill gesture. There’s no guarantee, and it’s not a right, but polite, well-timed requests sometimes work, especially when the account is now current.

The key is tone: take responsibility, explain the situation briefly, and emphasize your overall payment history.

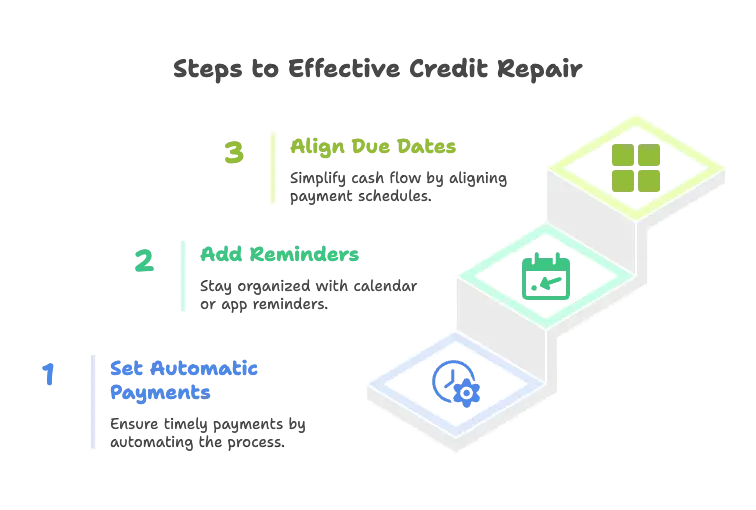

Automation and reminders to prevent future lates

The simplest credit repair tool is often the most effective:

- Set automatic payments for at least the minimum due

- Add calendar or app reminders several days before due dates

- Align due dates if possible to simplify cash flow

CreditStrong and Self both highlight automation as one of the most reliable ways to protect payment history going forward.

What to expect over time

How long late payments stay on reports

Late payments can remain on your credit reports for up to seven years, and some major negatives, like bankruptcies, can last even longer. That sounds discouraging, but duration isn’t the same as impact.

Why consistent on-time payments still rebuild credit

As myFICO and Bankrate explain, negative marks lose influence as they age, especially when they’re followed by a long streak of on-time payments. Scoring models reward recent positive behavior more than distant mistakes.

In practical terms: even if old lates can’t be removed, paying everything on time from this point forward is how your score gradually recovers, and stays recovered.

4. Slash Credit Utilization (The Fastest Score Win)

What credit utilization really is

Credit utilization measures how much of your available revolving credit you’re using at any given time. It’s calculated by dividing your reported balances by your total credit limits. High utilization signals risk; low utilization suggests control.

This factor lives under “amounts owed” in most scoring models, and it’s one of the fastest ways to move a credit score up or down without waiting months.

Revolving credit vs. installment loans

Not all debt is treated the same:

- Revolving credit (credit cards, lines of credit) has a credit limit and fluctuating balance. Utilization applies here.

- Installment loans (auto loans, personal loans, mortgages) have fixed payments and don’t use utilization in the same way.

That’s why maxing out a credit card often hurts more than having a sizable installment loan balance.

Why utilization is so influential

According to Experian and the Corporate Finance Institute, utilization shows how close someone is to their borrowing limit, a strong predictor of financial stress. Even if payments are on time, high utilization can drag down a score because it suggests overextension.

The good news: utilization updates whenever balances update. Lower the balance, and the score can respond quickly.

The 30% rule (and what high scorers actually do)

You’ll often hear that keeping utilization below 30% is “good.” That guideline exists for a reason: both Experian and Bankrate note that scores often begin to drop more sharply once utilization rises above that level.

But here’s the nuance:

- Below 30%: Generally safer territory

- Single digits: Common among consumers with the highest scores

Overall utilization vs. per-card utilization

Utilization is calculated two ways:

- Overall utilization: Total balances ÷ total limits across all cards

- Per-card utilization: Each individual card’s balance ÷ its limit

You can have low overall utilization and still lose points if one card is maxed out. Both matter.

Practical ways to lower utilization quickly

Paying down high-balance cards

Start with cards that are closest to their limits, especially those above 50%. Dropping these balances often delivers the biggest scoring impact.

Timing payments before statement dates

Credit card issuers typically report balances when statements close, not after payments are due. Making an extra payment before the statement closing date can lower the balance that gets reported, and instantly improve utilization.

Credit limit increases (and warnings)

Requesting a credit limit increase on accounts in good standing can lower utilization without paying anything down. But there’s a catch: this only helps if spending stays the same. A higher limit isn’t permission to carry more debt.

Avoiding maxed-out individual cards

If you must carry a balance, avoid letting any single card report near 100%. Spreading a balance across available limits can reduce per-card utilization, which scoring models tend to favor.

5. Add Fresh Positive History (Secured Cards & Builder Loans)

When to add new credit, and when not to

New credit can help rebuild a damaged profile, but only at the right time. If your reports are still riddled with errors, accounts are past due, or balances are maxed out, adding new accounts won’t fix the core problem. In some cases, it can even make things worse by introducing hard inquiries or spreading attention too thin.

Why cleanup comes before adding accounts

Credit scores reward consistency, not activity. That’s why the earlier fixes, disputing errors, getting current on payments, and lowering utilization, come first. Once the negative drag is controlled, new positive data has room to actually matter. This sequencing is backed by both Experian and myFICO, which stress that clean, well-managed accounts outperform cluttered credit profiles every time.

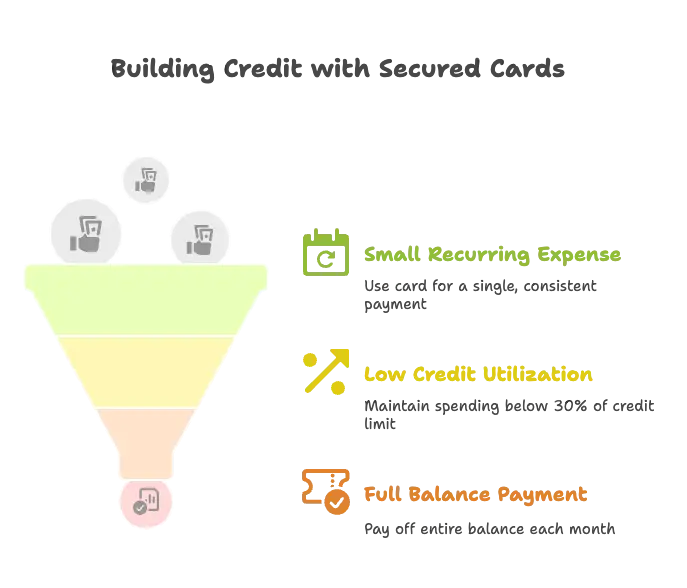

Secured credit cards

How they work

A secured credit card requires a refundable cash deposit, often $200 to $500, that becomes your credit limit. Aside from the deposit, it functions like a regular credit card: monthly statements, due dates, and on-time payments reported to the credit bureaus.

Because the issuer’s risk is reduced, secured cards are widely available to people with bad or limited credit.

How to use them safely and effectively

The goal isn’t spending, it’s reporting positive behavior.

- Use the card for one small recurring expense

- Keep utilization low (ideally under 10–30%)

- Pay the balance in full every month

When used this way, secured cards can quietly rebuild payment history without adding interest or debt. Over time, many issuers allow upgrades to unsecured cards, returning the deposit.

Credit-builder loans

What they are

Credit-builder loans are designed specifically to build credit, not to provide spending money. Typically offered by credit unions, community banks, or fintech lenders, the borrowed amount is held in a savings account or certificate while you make fixed monthly payments.

Once the loan is paid off, the funds are released to you.

How they help payment history and credit mix

Each on-time payment is reported to the credit bureaus, strengthening payment history, the most important scoring factor. These loans also add installment credit to your profile, improving credit mix, which myFICO notes can support higher scores over time when managed responsibly.

Don’t sabotage progress

Why keeping old positive accounts open matters

Closing long-standing, positive accounts can backfire. Older accounts help:

- Lengthen average credit history

- Increase total available credit

- Lower utilization ratios

Even if you no longer use an old card, keeping it open (with occasional activity) can protect these factors. Both Experian and myFICO warn that unnecessary closures often hurt more than they help.

6. Warning: Avoid Credit Repair Scams

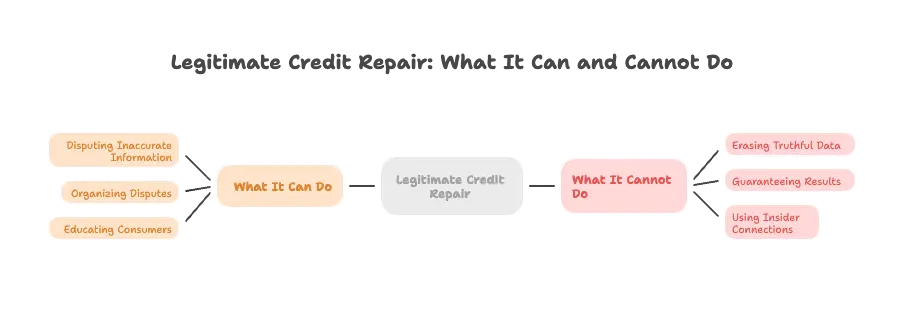

What legitimate credit repair can, and cannot, do

Legitimate credit repair is limited, and that’s by design. Under U.S. law, accurate negative information has the right to exist on your credit report for a set period. No company, software, or “insider connection” can legally erase truthful data on demand.

What is legitimate:

- Disputing inaccurate or incomplete information

- Helping organize disputes and documentation

- Educating consumers on credit laws and best practices

What isn’t:

- Deleting real late payments or collections simply because you paid a fee

- Creating shortcuts around credit reporting rules

Both the FTC and CFPB are clear: if the information is accurate, it generally stays until it ages off.

Why accurate negatives can’t be removed early

Late payments, charge-offs, and collections usually remain on reports for up to seven years, while some bankruptcies can last longer. These timelines exist to give lenders a consistent risk history.

The important distinction: duration is not the same as impact. Negative items lose influence over time, especially when they’re followed by consistent on-time payments. That’s how real rebuilding happens.

Red flags readers must know

Credit repair scams tend to reuse the same promises, just with new branding.

“New credit identity” or CPN schemes

Any service that suggests using a “credit privacy number” (CPN) or creating a new identity instead of your Social Security number is pushing something that can cross into fraud. The FTC explicitly warns consumers about these schemes.

Guarantees and upfront fees

Promises like “We’ll raise your score 200 points” or demands for payment before any work is done are major red flags. No one can legally guarantee a specific credit outcome.

Why DIY credit repair usually works best

For most people, paying for credit repair isn’t necessary. The core actions, pulling reports, disputing errors, setting up payments, are things consumers can do themselves for free.

Conclusion: A Realistic Credit Rebuild Roadmap

The correct order to fix bad credit

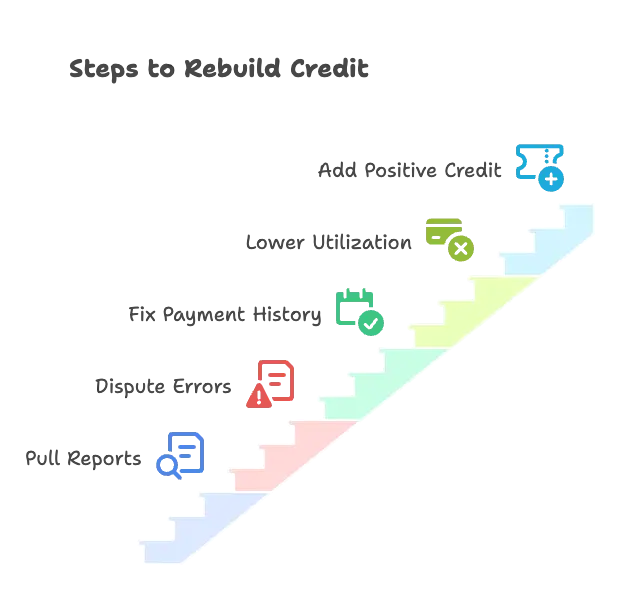

Rebuilding credit isn’t about doing everything, it’s about doing the right things in the right sequence:

- Pull reports to see exactly what lenders see

- Dispute errors that are dragging your score down unfairly

- Fix payment history by getting current and staying current

- Lower utilization to signal financial control

- Add controlled positive credit once the foundation is clean

Why consistency beats shortcuts

Credit scores reward patterns, not tricks. A single month of good behavior won’t undo years of damage, but steady progress will. Every on-time payment, lower balance, and clean report compounds over time.

What readers should focus on over the next 3–12 months

- Zero new late payments

- Utilization trending downward, not creeping up

- One or two well-managed credit-building tools

- Regular report reviews, not daily score checking

Bad credit isn’t permanent, but fixing it requires patience, order, and follow-through. Do the basics well, and the score will catch up.

Leave a comment

Your email address will not be published. Required fields are marked *