Credit isn’t just a number. It’s leverage. It quietly shapes where you live, what you pay, and how easily you can move through adult life. Yet for something so powerful, credit is rarely explained clearly, especially to beginners. Most people learn the hard way, through rejections, higher interest rates, or costly mistakes that linger for years.

This guide exists to change that.

Why Credit Matters More Than People Think

Your credit profile is used far beyond credit cards and loans. Landlords check it before approving leases. Auto insurers may factor it into your premiums. Utility companies use it to decide whether you need a deposit. In some cases, employers even review credit reports as part of background checks.

Good credit lowers friction. It unlocks better rates, more options, and flexibility when life throws curveballs. Poor or nonexistent credit does the opposite, it quietly taxes you with higher costs and fewer choices. The difference between “approved” and “denied,” or between a 6% rate and a 22% rate, often comes down to habits built months or years earlier.

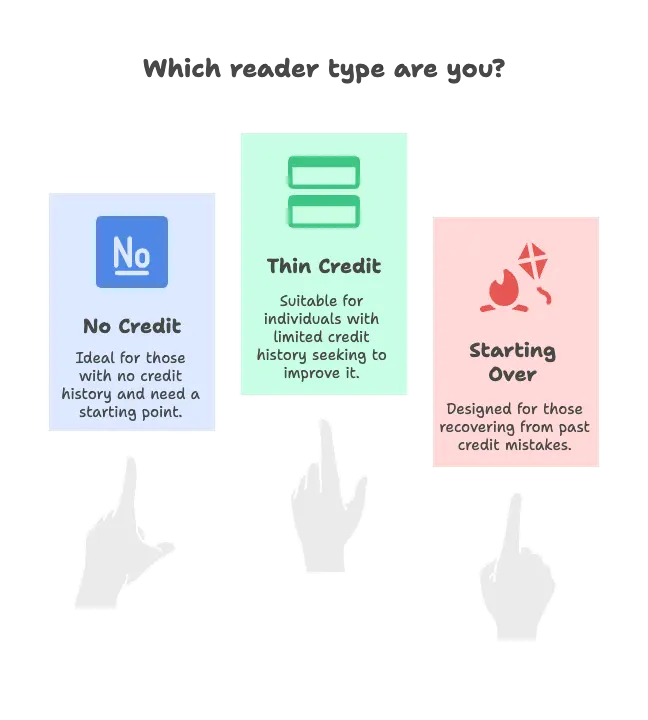

Who This Guide Is For

This guide is designed for three types of readers:

- If you have no credit at all and don’t know where to start

- If you have thin credit (maybe one account or a short history) and want to strengthen it

- If you’re starting over after missed payments, collections, or past mistakes

You don’t need to be an expert. You don’t need perfect finances. You just need a willingness to build intentionally instead of guessing.

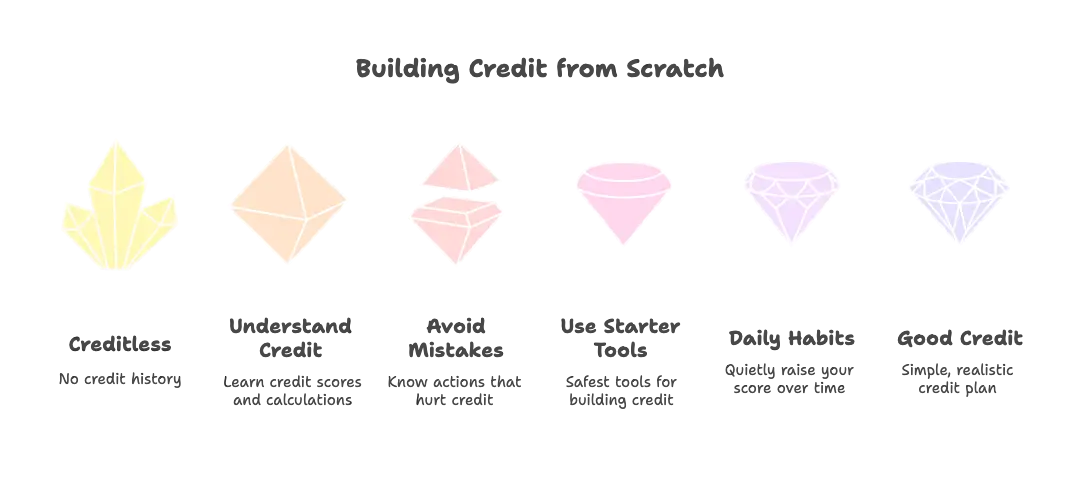

What You’ll Learn, And How to Use This Guide

You’ll learn:

- What credit actually is and how scores are calculated

- Which actions help most at the beginning, and which mistakes hurt the fastest

- The safest starter tools for building credit from scratch

- Daily habits that quietly raise your score over time

- How to create a simple, realistic credit plan you can stick to

This guide is meant to be used, not skimmed. Read it once to understand the system, then come back step by step. Start where you are. Apply one concept at a time. Credit isn’t built overnight, but with the right structure, it is built predictably.

Think of this not as advice, but as a playbook.

What “Credit” Really Is

At its core, credit is trust, quantified. It’s a financial reputation system that answers one question: How reliably do you handle borrowed money? Every time you open an account, make a payment, miss a due date, or carry a balance, you’re adding data points to that reputation.

Lenders don’t know you personally. Your credit history becomes the stand-in for character, consistency, and risk. Over time, those signals are collected, standardized, and distilled into something simple enough to judge quickly, your credit profile.

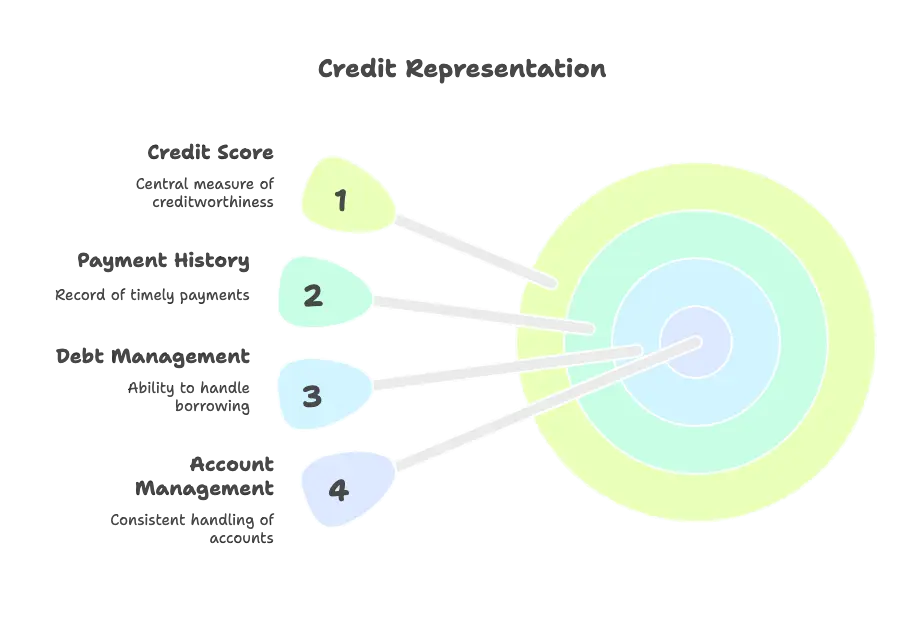

What Credit Actually Represents

Credit represents your past behavior predicting future behavior. It doesn’t measure income, intelligence, or ambition. It measures patterns:

- Do you pay what you owe?

- Do you borrow more than you can handle?

- Do you manage accounts over time without issues?

That’s why two people earning the same salary can receive wildly different loan terms. Credit isn’t about how much money you make, it’s about how you’ve handled money that wasn’t yours yet.

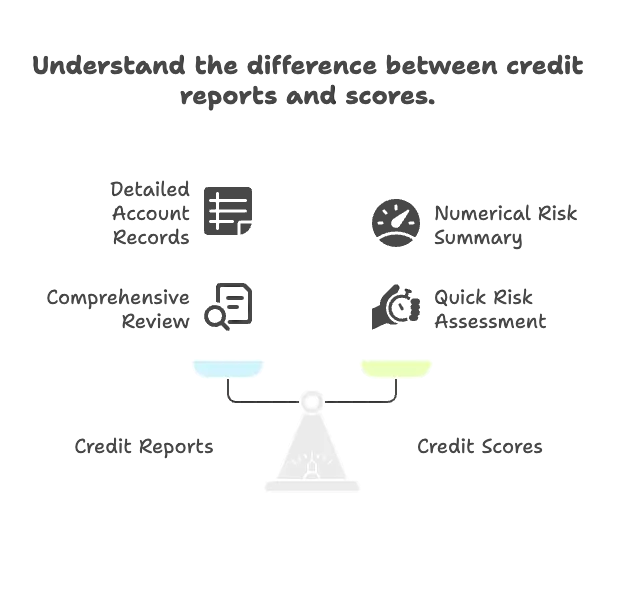

Credit Reports vs. Credit Scores

These two terms are often used interchangeably, but they’re not the same.

- Credit reports are detailed records maintained by credit bureaus. They list your accounts, balances, payment history, inquiries, and any negative marks like late payments or collections.

- Credit scores are numerical summaries derived from the information in your credit reports. Most scores fall within a 300–850 range and are designed to predict lending risk at a glance.

Think of your credit report as the full story, and your credit score as the headline. The score reacts to what’s inside the report, nothing more, nothing less.

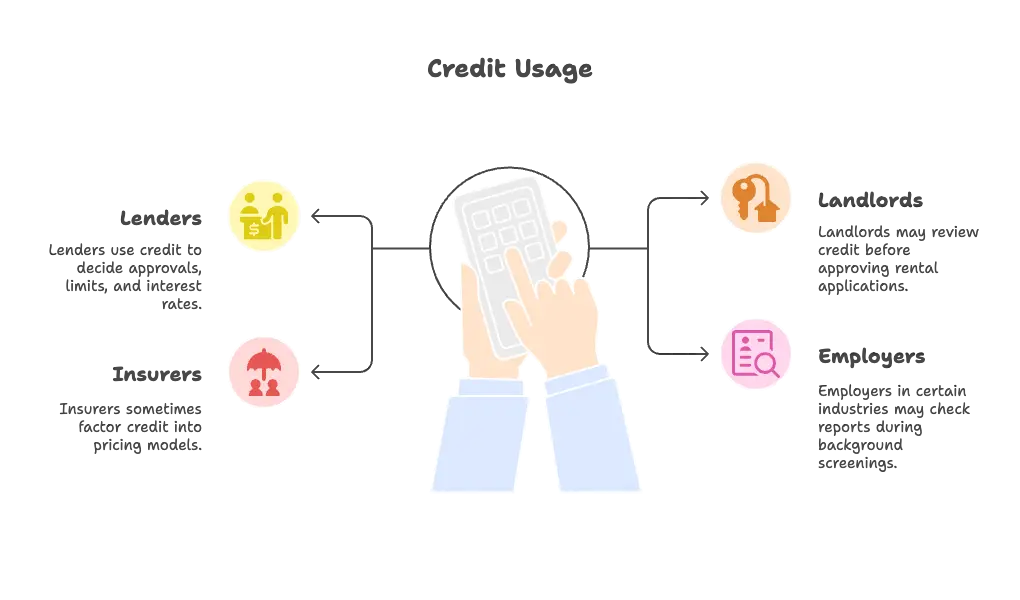

Who Uses Your Credit

Credit doesn’t live in a vacuum. It’s consulted across multiple parts of adult life:

- Lenders use it to decide approvals, limits, and interest rates

- Landlords may review it before approving rental applications

- Insurers sometimes factor credit into pricing models

- Employers in certain industries may check reports during background screenings

In each case, credit helps decision-makers estimate reliability and risk. Strong credit widens your options. Weak credit narrows them.

The Five Core Factors That Shape Your Credit Score

Most major scoring models weigh similar factors, even if the exact formulas differ. Understanding these five pillars gives you clarity on what actually moves the needle.

Payment History

This is the single most important factor. It tracks whether you pay your bills on time and how often you miss due dates.

One late payment can stay on your report for years, while consistent on-time payments quietly strengthen your profile month after month. Reliability matters more than perfection, but late payments are costly.

Amounts Owed / Credit Utilization

This measures how much of your available credit you’re using, especially on credit cards.

Using a high percentage of your limit signals risk, even if you pay on time. Lower balances relative to your limits generally indicate better control. Utilization is one of the fastest factors to improve, and one of the easiest to damage.

Length of Credit History

Time matters. This factor looks at how long your accounts have been open and how established your overall history is.

Longer histories provide more data and reduce uncertainty. That’s why starting early and keeping well-managed accounts open can work in your favor over time.

Credit Mix

Credit mix refers to the variety of accounts you manage, such as credit cards, auto loans, student loans, or installment loans.

You don’t need every type of credit to have a strong score, but responsibly handling different account types can help demonstrate versatility and stability as your profile matures.

New Credit & Inquiries

Every time you apply for credit, a hard inquiry may appear on your report. Too many applications in a short period can suggest financial stress or over-borrowing.

Spacing out applications and only applying for what you actually need keeps this factor from working against you.

Understanding these five factors turns credit from a mystery into a system. Once you know what’s being measured, you can start making moves that are intentional, not accidental.

Step 1: Check Where You Stand

Before you can build credit, you need to see what already exists, or whether anything exists at all. Skipping this step is like trying to fix your finances with your eyes closed. Your credit report tells the truth about where you’re starting, and that starting point matters more than any strategy you choose next.

Why Checking Your Credit Is the First Move

Many beginners assume they have “no credit,” only to discover old accounts, forgotten student loans, or even errors dragging them down. Others underestimate how thin their file really is. Checking your credit removes guesswork and prevents you from building on faulty information.

More importantly, reviewing your credit does not hurt your score when you check it yourself. This is a common myth, and believing it keeps people in the dark longer than necessary.

Where Beginners Can Access Free Credit Reports

In the U.S., you’re entitled to free credit reports from each of the three major bureaus:

- Experian

- Equifax

- TransUnion

The official, federally authorized source is AnnualCreditReport.com, where you can pull reports without affecting your score. Many banks and financial apps also offer free access to reports or score summaries as part of their services.

For beginners, pulling at least one full report is essential. Ideally, review all three over time, since the information can vary slightly between bureaus.

Credit Reports vs. Credit Monitoring Tools

It’s important to understand the difference:

- Credit reports show the raw data: accounts, balances, payment history, and negative marks.

- Credit monitoring tools track changes to your credit over time and often provide alerts, summaries, and estimated scores.

Monitoring tools are useful for ongoing awareness, but they don’t replace the need to read your actual credit report line by line, especially at the beginning.

What to Look for on Your Credit Report

When reviewing your report, slow down. Accuracy matters, and small errors can have outsized effects.

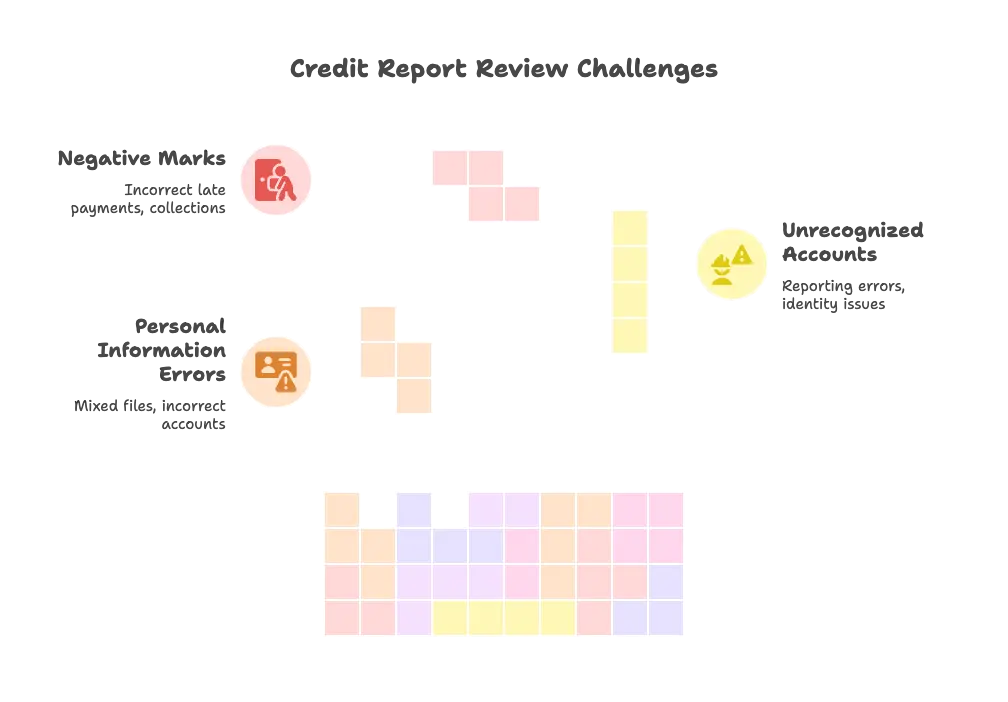

Personal Information Accuracy

Check your:

- Name and spelling

- Address history

- Social Security number (partially masked)

Incorrect personal information can lead to mixed files or accounts being incorrectly linked to you.

Accounts You Don’t Recognize

Scan the list of open and closed accounts carefully. If you see:

- Accounts you never opened

- Accounts opened in the wrong time period

- Duplicate listings

These could signal reporting errors or, in rare cases, identity issues that need immediate attention.

Late Payments, Collections, or Errors

Negative marks deserve special scrutiny. Look for:

- Late payments you don’t remember or believe are incorrect

- Collections that don’t belong to you

- Accounts showing incorrect balances or statuses

Not every negative item can be removed, but incorrect ones should not stay on your report.

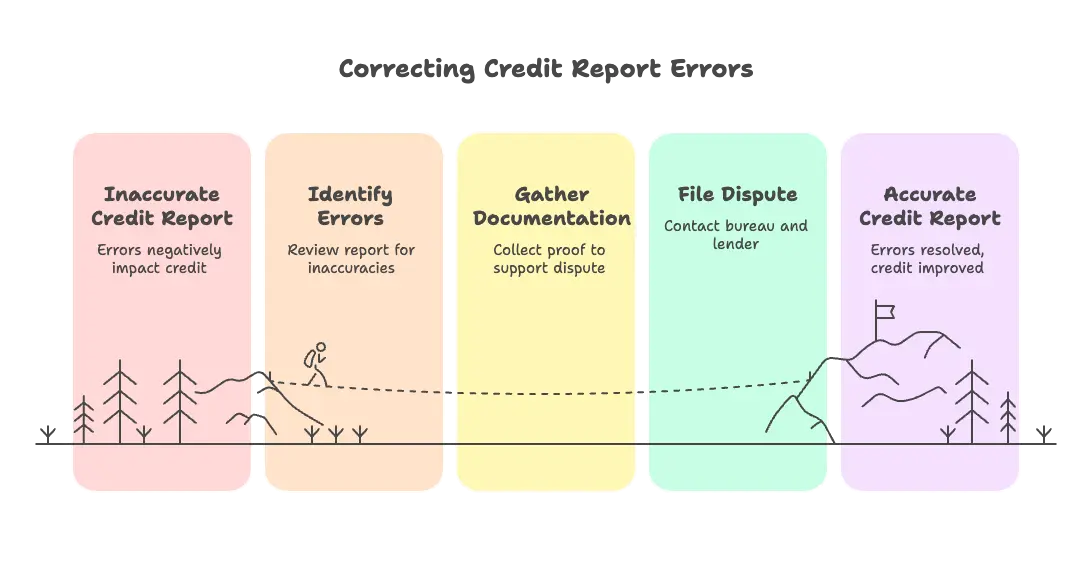

How and When to Dispute Errors

If you find mistakes, don’t ignore them. Credit reports are not permanent records, they can be corrected.

What Can Be Disputed

You can dispute:

- Incorrect personal information

- Accounts that aren’t yours

- Wrong payment statuses

- Inaccurate balances or dates

Disputes should be factual and specific, not emotional or vague.

Who to Contact

Disputes are typically filed with:

- The credit bureau reporting the error

- The lender or collection agency that furnished the information

Most bureaus allow disputes online, by mail, or by phone, though written records are always safest.

What Documentation to Keep

Save copies of:

- Credit reports showing the error

- Bills, statements, or receipts that prove your claim

- Confirmation numbers or correspondence from bureaus or lenders

Documentation protects you if disputes take time or need follow-up. Once errors are resolved, you’re no longer guessing, you’re building credit on solid ground.

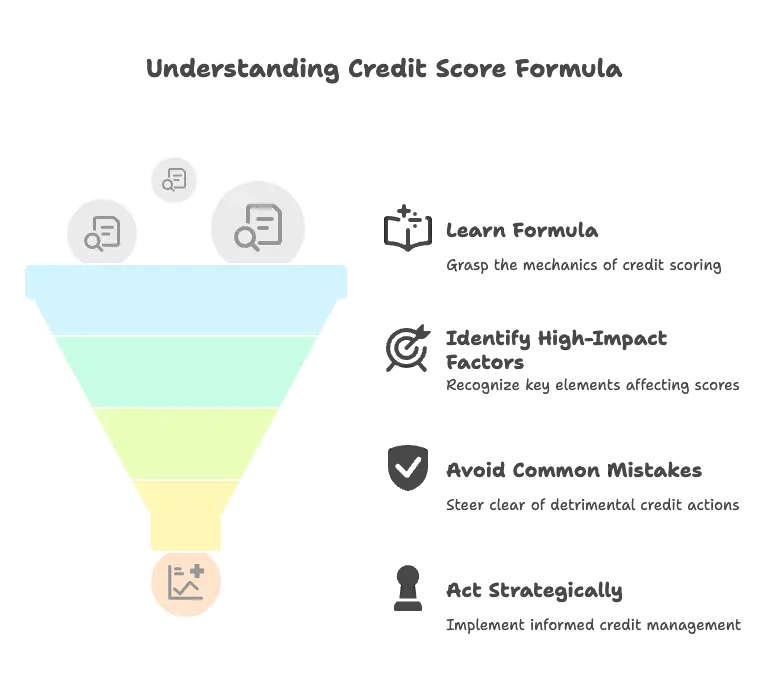

Step 2: Learn the “Credit Score Formula”

Once you’ve seen your credit report, the next step is understanding how your actions translate into a score. Credit scoring isn’t random, and it isn’t secret magic. It’s a formula. And like any formula, misunderstanding it leads to avoidable mistakes.

Why Understanding the Formula Prevents Mistakes

Most credit damage doesn’t come from irresponsibility, it comes from misinformation. Beginners carry balances because they think it helps. They close old accounts to “clean things up.” They apply for multiple cards at once, assuming more options mean faster progress.

Knowing how scores are calculated flips the script. You stop reacting emotionally and start acting strategically. When you understand what actually moves the score, you can focus your effort where it matters instead of chasing myths.

Overview of How Scores Are Calculated

While different scoring models exist, most major credit scores are built from the same core ingredients. Each factor is weighted based on how predictive it is of future repayment behavior. Some actions have long-term effects, while others can move your score surprisingly fast, both up and down.

The key takeaway: not all factors are equal. A small mistake in a high-impact area can outweigh several “good” moves elsewhere.

Credit Score Factors Explained

Credit Score Factor | What It Measures | Why It Matters |

Payment history | Whether you pay on time | The strongest predictor of future behavior |

Credit utilization | How much of your available credit you use | Signals risk when balances are high |

Length of history | How long accounts have been open | Longer histories reduce uncertainty |

Credit mix | Variety of account types | Shows you can manage different obligations |

New credit | Recent applications and inquiries | Too many can suggest instability |

Payment History

This factor tracks consistency. On-time payments strengthen your score quietly but powerfully. Late payments do the opposite, and the later they are, the more damage they cause. One missed payment can outweigh months of good behavior.

Credit Utilization

Utilization measures how much of your available credit you’re using, especially on revolving accounts like credit cards. High balances relative to limits raise red flags, even if you pay on time. Low utilization suggests control and restraint.

This is one of the fastest-moving factors, meaning your score can change noticeably as balances rise or fall.

Length of History

Time adds credibility. This factor looks at the age of your oldest account, your newest account, and the average age of all accounts. Closing older, well-managed accounts can shorten your history and unintentionally lower your score.

Credit Mix

Credit mix rewards balance, not complexity. You don’t need multiple loans to build good credit, but responsibly managing different types of accounts over time can strengthen your profile as it matures.

New Credit

Each credit application can trigger a hard inquiry. A few inquiries over time are normal, but many in a short period can signal financial stress. This factor encourages patience and intentional borrowing.

What Beginners Should Focus on First

The Two Factors That Matter Most Early On

For beginners, payment history and credit utilization do the heavy lifting. Together, they make up the majority of your score and are the areas where habits matter most.

Paying on time builds trust. Keeping balances low shows discipline. If you do nothing else perfectly, do these two things consistently.

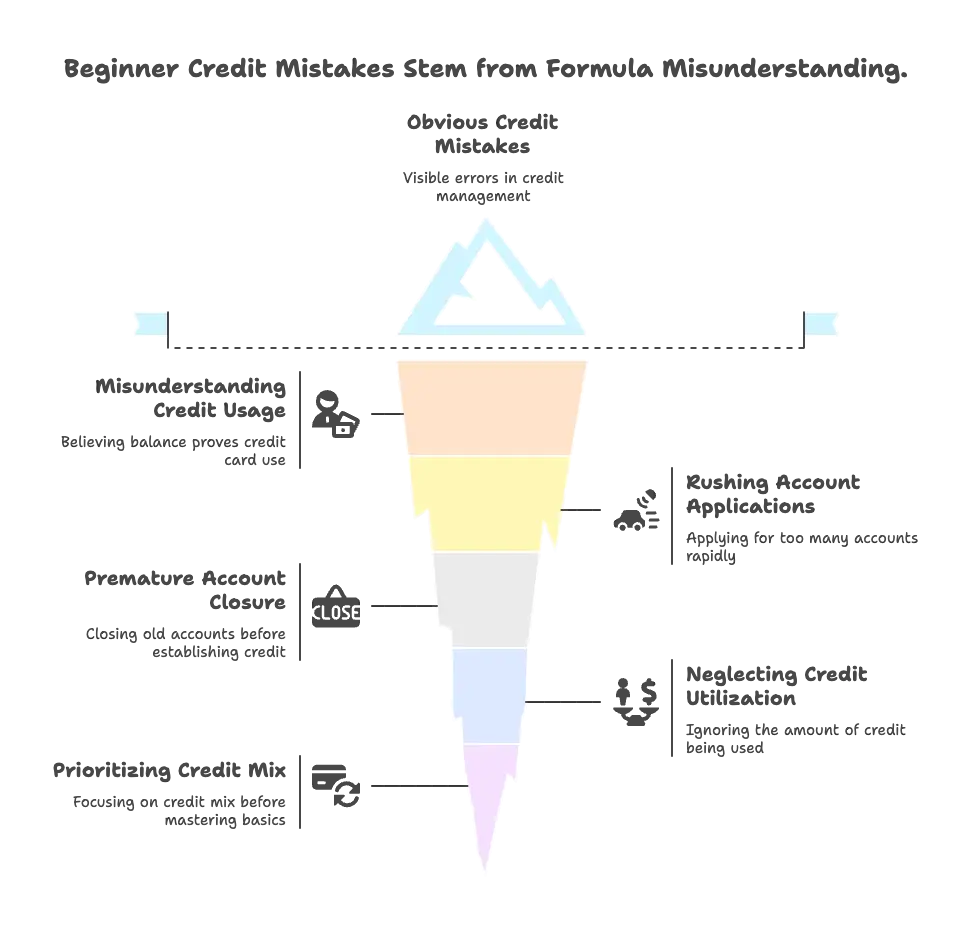

Common Beginner Mistakes Tied to Misunderstanding the Formula

- Carrying a balance to “prove usage”

- Applying for too many accounts too quickly

- Closing old accounts too soon

- Ignoring utilization because payments are on time

- Chasing credit mix before mastering the basics

Once you understand the formula, credit stops feeling unpredictable. It becomes a system you can work with, calmly, deliberately, and in your favor.

Curious how close you are to a 750 credit score?

Take the 2-minute quiz to see where you stand, what’s holding you back, and the exact steps to level up your credit faster.

Step 3: Starter Credit-Building Tools

When you’re new to credit, traditional products aren’t designed with you in mind. Most standard credit cards and loans assume an existing track record, and without one, approvals are harder, limits are lower, and terms are worse. That’s where starter credit-building tools come in.

Why Beginners Need Specialized Credit Products

Beginners don’t need more credit, they need reported history. Specialized credit products are built to reduce lender risk while still giving you a chance to prove reliability. They create a low-stakes environment where on-time payments and good habits can be documented without the dangers that come with high limits or complex terms.

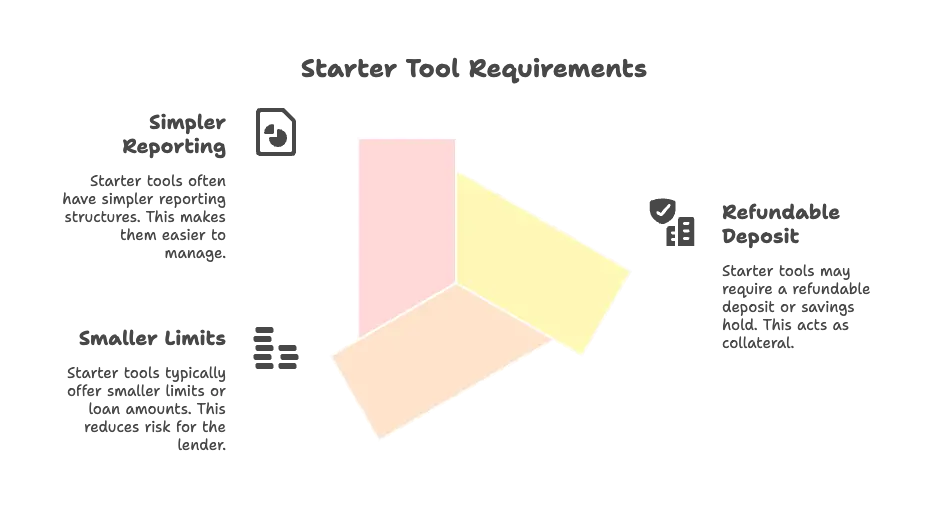

How These Tools Differ From Traditional Credit

Starter tools often require:

- A refundable deposit or savings hold

- Smaller limits or loan amounts

- Simpler reporting structures

In exchange, they’re easier to qualify for and more forgiving while you learn. Used correctly, they act as training wheels, temporary, but valuable.

Secured Credit Cards

How Secured Cards Work

A secured credit card functions like a regular credit card, but it’s backed by your own money. You provide a cash deposit upfront, and that deposit becomes collateral for the account. The card can be used anywhere it’s accepted, and your activity is reported to the credit bureaus.

Deposit vs. Credit Limit

In most cases, your deposit equals your credit limit. A $300 deposit typically means a $300 limit. The deposit protects the issuer if you fail to pay, which is why secured cards are accessible to beginners.

The key point: the deposit is not a fee. It’s usually refundable when you close the account in good standing or graduate to an unsecured card.

How Secured Cards Report to Bureaus

Reputable secured cards report your payment history and balances to one or more major credit bureaus, often the same way unsecured cards do. This reporting is what builds your credit, not the deposit itself.

Before applying, always confirm that the card reports regularly.

Best Practices for Using a Secured Card

Ideal Usage Levels

Low utilization is your advantage. Aim to use a small portion of your limit each month, enough to show activity, but not enough to raise red flags. Lower balances consistently send stronger signals than maxed-out cards paid at the last minute.

Payment Strategies

Pay on time, every time. Ideally, pay the balance in full before the due date. Setting up automatic payments helps remove human error from the process.

One late payment can undo months of progress.

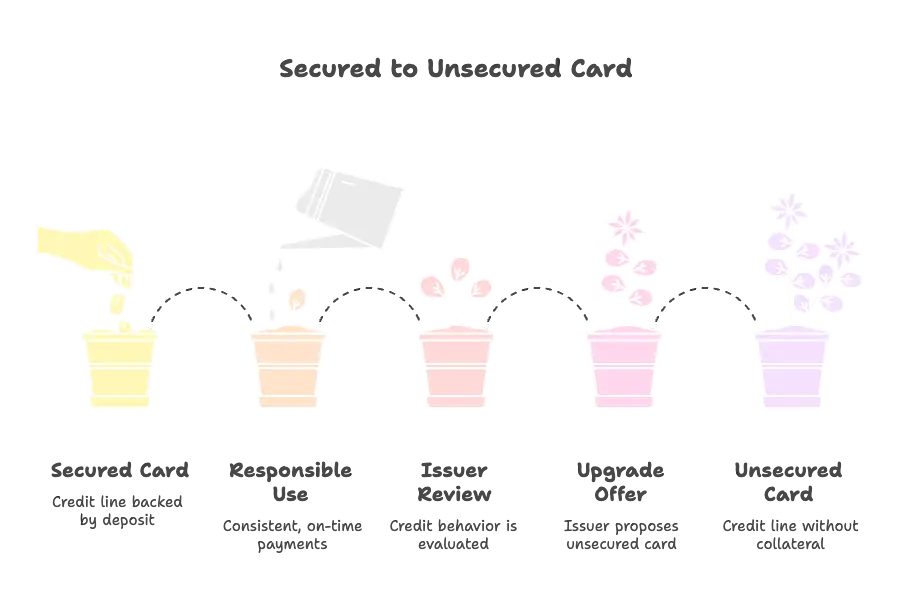

Graduation to Unsecured Cards

Many secured cards offer a path to upgrade. After a period of responsible use, issuers may:

- Increase your limit

- Refund your deposit

- Convert the account to an unsecured card

Graduation is a milestone, it signals that your credit behavior is being trusted without collateral.

Credit-Builder Loans

What a Credit-Builder Loan Is

A credit-builder loan is a small installment loan designed for people without established credit. Instead of receiving the money upfront, the funds are placed in a locked savings account or certificate until the loan is fully paid.

How Payments Are Structured

You make fixed monthly payments over a set term. Each payment is reported to the credit bureaus as an on-time installment payment, building your history gradually.

What Happens at the End of the Loan

Once all payments are completed, the locked funds are released to you, often leaving you with both improved credit and a small savings balance.

What Beginners Should Watch Out For

Fees and Interest

Some credit-builder loans come with setup fees or interest that outweigh their benefits. Always compare total cost to the value of the credit history being built.

Reporting Practices

Not all lenders report to all bureaus. Confirm which bureaus receive your payment history before committing.

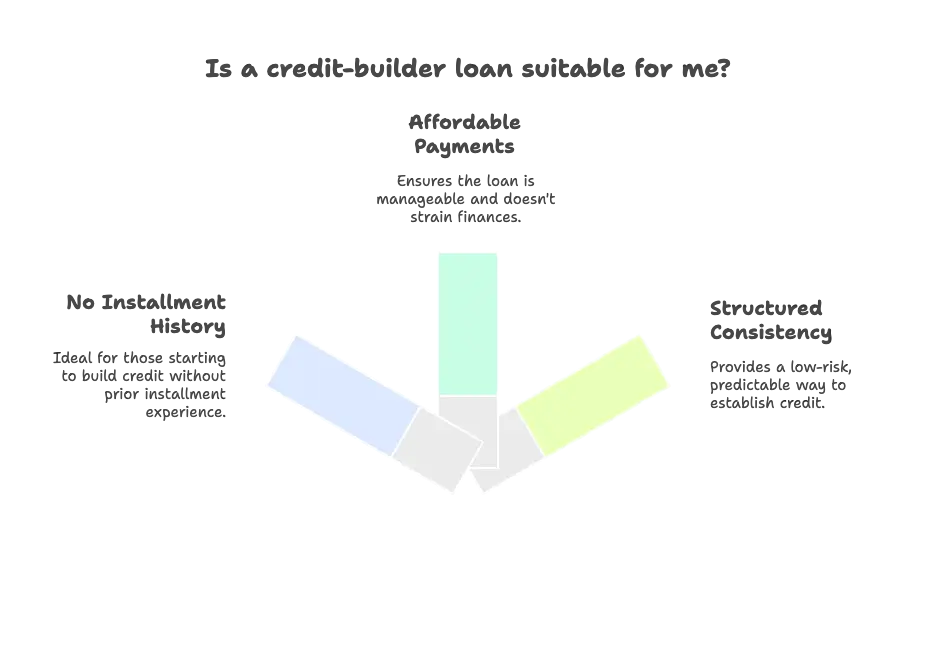

When a Credit-Builder Loan Makes Sense

These loans work best if you:

- Have no installment history

- Can afford the monthly payment comfortably

- Want a structured, low-risk way to build consistency

They are less useful if fees are high or reporting is limited.

Authorized User Status

What Being an Authorized User Means

As an authorized user, you’re added to someone else’s credit card account. The account’s history, both positive and negative, may appear on your credit report, depending on the issuer and scoring model.

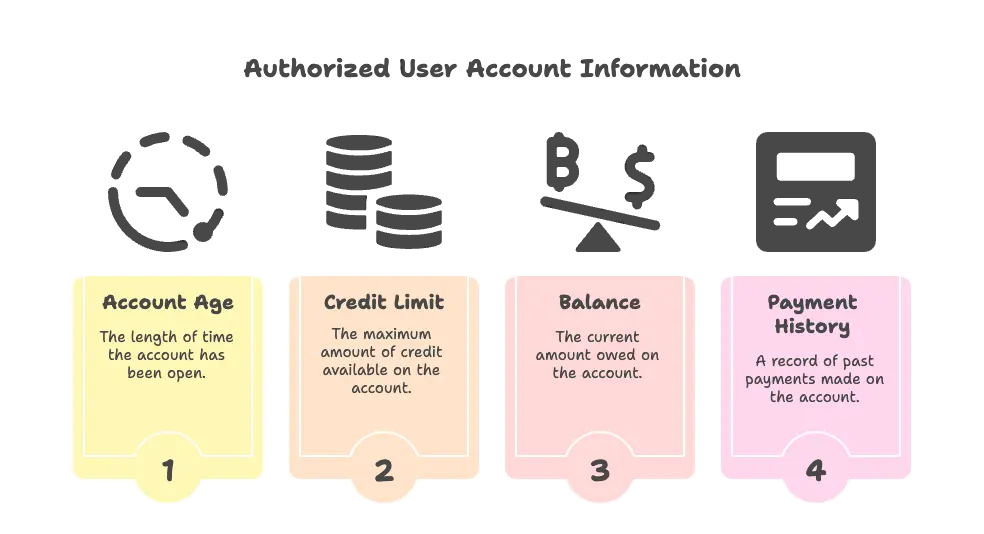

How Authorized User Accounts Appear on Reports

When reported, authorized user accounts can show:

- Account age

- Credit limit

- Balance

- Payment history

This can instantly lengthen your credit history, but it also ties your score to someone else’s habits.

Risks and Limitations

When Authorized User Status Helps

Authorized user status works best when:

- The primary cardholder pays on time

- Utilization is kept low

- The account has a long, clean history

When It Can Hurt

It backfires when:

- The primary user misses payments

- Balances stay high

- The account is mismanaged

Your score can drop without you doing anything wrong.

How to Remove Yourself If Needed

Authorized users can usually be removed at any time. Once removed, the account typically disappears from your credit report within a few reporting cycles, remembering that removal can lower your score if that account was boosting your history.

Used wisely, these starter tools don’t just build credit, they build confidence.

Step 4: Build Daily Credit Habits

Credit isn’t built by big moves, it’s built by quiet, repeatable behavior. The tools you use matter, but habits matter more. Two people can have the same credit card and the same limit, yet end up with completely different outcomes based on what they do every month.

Why Habits Matter More Than Shortcuts

Shortcuts chase speed. Habits create durability.

Many beginners look for hacks, carrying balances, opening multiple accounts at once, or using “boost” features without understanding them. These tactics might create temporary movement, but they’re fragile. One mistake can erase months of progress.

Strong credit is boring by design. It rewards consistency, not cleverness. When your habits are solid, your score improves naturally, and stays improved.

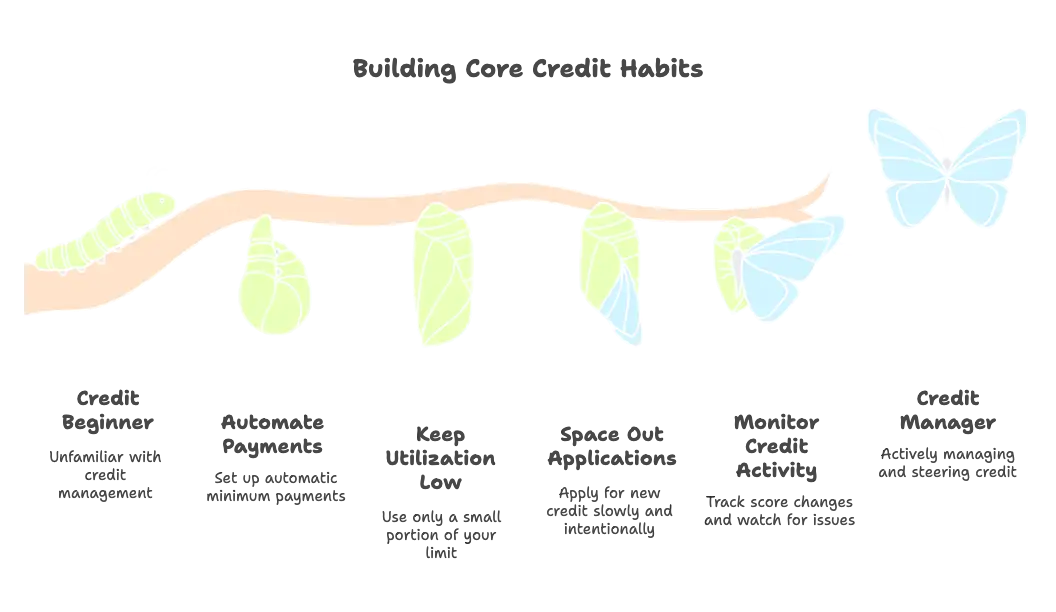

Core Credit Habits for Beginners

Paying on Time (Automation & Reminders)

Payment history is the most powerful force in your credit profile, and the easiest way to protect it is automation.

Set up:

- Automatic minimum payments as a safety net

- Calendar reminders before due dates

- Notifications from your bank or card issuer

Even one late payment can follow you for years. Automation turns reliability into a default, not a test of memory.

Keeping Utilization Low

Utilization reflects restraint. High balances signal risk, even if you pay on time.

To keep utilization low:

- Use only a small portion of your limit

- Pay balances down before the statement closes

- Avoid maxing out cards “just because you can”

Lower utilization doesn’t just help your score, it keeps you flexible if emergencies arise.

Spacing Out Credit Applications

Every application sends a signal. Too many at once suggests instability.

Apply for new credit slowly and intentionally:

- Only when you have a clear purpose

- With months between applications

- After confirming you’re likely to qualify

Patience here protects your score and preserves options later.

Monitoring Credit Activity Regularly

Monitoring doesn’t mean obsessing, it means staying informed.

Use free tools to:

- Track score changes

- Watch for unfamiliar accounts or inquiries

- Confirm that payments are being reported correctly

Catching issues early is far easier than fixing them later. Awareness turns credit from something that “happens to you” into something you actively manage.

When these habits become routine, credit building stops feeling stressful. You’re no longer reacting, you’re steering.

Step 5: Add Alternative Data (Where Available)

For beginners with little or no credit history, the problem isn’t always bad behavior, it’s a lack of recorded behavior. Alternative data exists to help fill that gap by capturing payments you’re already making, but that traditional credit systems may not automatically count.

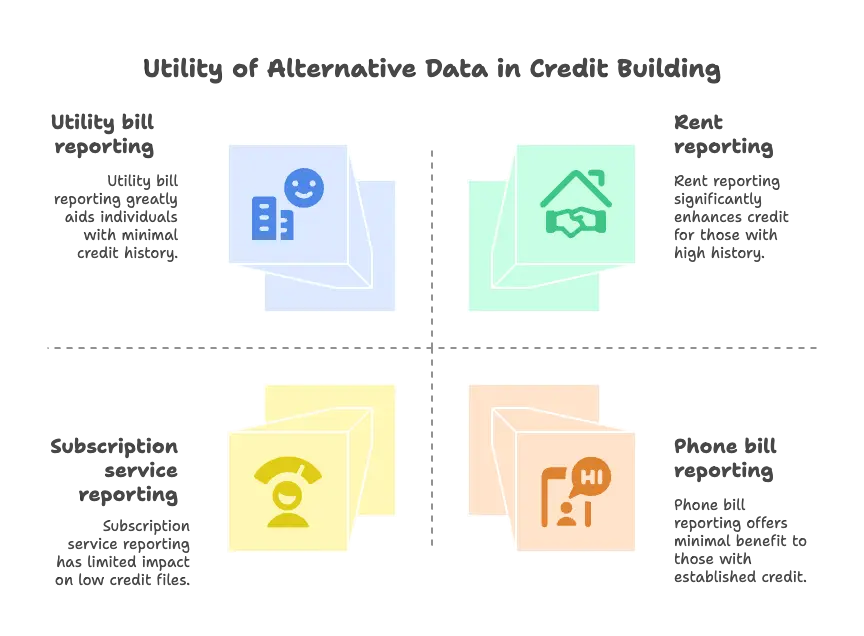

What Alternative Data Is

Alternative data refers to non-traditional financial payments that can be added to your credit file to help demonstrate reliability. These are everyday obligations that show consistency, even though they aren’t loans or credit cards.

Used correctly, alternative data can strengthen thin files, but it’s a supplement, not a replacement.

Types of Bills That May Count

Depending on the service and bureau, alternative data can include:

- Rent payments

- Utility bills (electric, water, gas)

- Phone and internet bills

- Streaming or subscription services

These payments must typically be verified and reported through approved programs or platforms.

When Alternative Data Helps Most

Thin or New Credit Files

Alternative data is most useful when:

- You have little or no credit history

- You’re early in the credit-building process

- Your report lacks recent activity

In these cases, added data can help your file look more complete and active.

Rent and Utility Reporting

Rent is often the largest monthly payment people make, and historically, it hasn’t counted. Rent-reporting services change that by documenting on-time payments, which can be especially helpful for renters trying to qualify for future housing or loans.

Utility reporting works similarly, adding more proof of consistency over time.

Important Limitations to Understand

Which Bureaus Receive the Data

Not all alternative data is shared with all three credit bureaus. Some programs report to only one bureau, which means lenders using other reports may never see it.

Before enrolling, confirm:

- Which bureau(s) receive the data

- Whether those bureaus are commonly used by lenders you care about

Why Traditional Credit Still Matters More

Alternative data can help, but traditional credit accounts carry more weight in scoring models. Credit cards and loans remain the strongest indicators of borrowing behavior.

Think of alternative data as reinforcement, not the foundation. It works best alongside on-time payments, low utilization, and responsible use of traditional credit products.

When used intentionally, alternative data can support your progress without distracting from the habits that matter most.

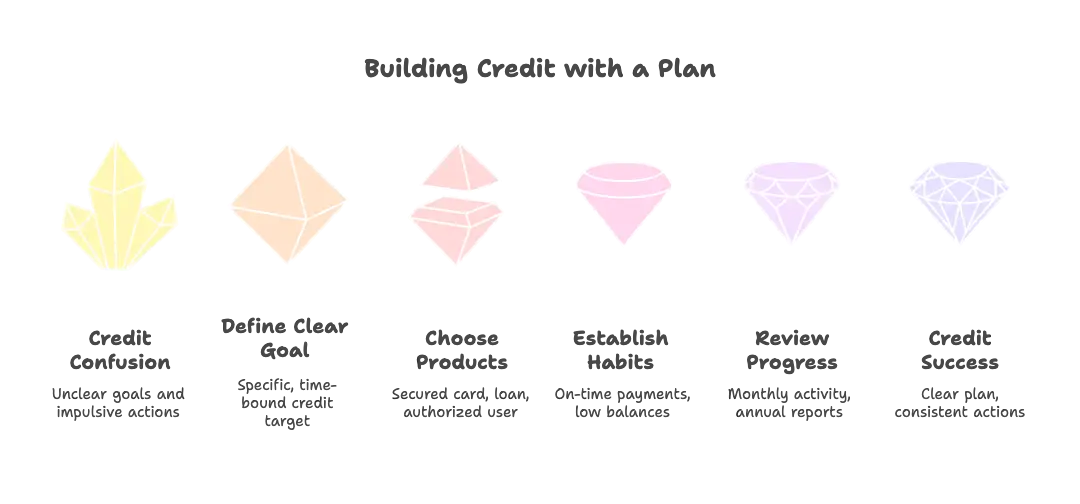

Step 6: Create a Simple Credit Action Plan

Information builds awareness. A plan builds results.

A simple, written credit action plan turns everything you’ve learned into something repeatable, and removes emotion from the process.

Why a Written Plan Increases Success

Credit progress is slow enough that it’s easy to lose focus or second-guess yourself. A written plan gives you:

- Clarity on what you’re working toward

- Guardrails against impulsive decisions

- A way to measure progress without obsessing

When your plan is clear, your actions become automatic.

What to Include in Your Credit Plan

A Clear Credit Goal

Your goal should be specific and time-bound, not vague. Examples:

- Qualify for an apartment lease within 12 months

- Reach a 700+ credit score

- Be approved for an unsecured credit card

A clear target keeps you patient and consistent.

Products You’ll Use

List the tools you’re committing to, such as:

- One secured credit card

- One credit-builder loan

- Authorized user status (if applicable)

More products don’t mean faster progress. Simplicity improves follow-through.

Monthly Habits to Follow

Your plan should emphasize behaviors, not tricks:

- Pay every account on time

- Keep balances low

- Avoid unnecessary applications

- Monitor reports and alerts

These habits compound quietly.

How Often to Review Progress

Check progress without overreacting:

- Monitor activity monthly

- Review full reports once or twice a year

- Adjust your plan only when necessary

Credit rewards patience. Over-tinkering often causes harm.

Common Credit Myths Beginners Should Ignore

“Carrying a Balance Builds Credit”

It doesn’t. Interest builds bank profits, not your score. Paying on time matters; carrying debt does not.

“Checking Your Own Credit Hurts Your Score”

False. Personal checks are soft inquiries and have no negative impact. Avoiding your credit out of fear only delays improvement.

“You Need Debt to Build Credit”

You need activity, not debt. Low balances paid on time build credit just as effectively, without the financial drag.

A simple plan, followed consistently, outperforms complicated strategies every time. Credit isn’t about perfection. It’s about repetition.

How Long Credit Building Really Takes

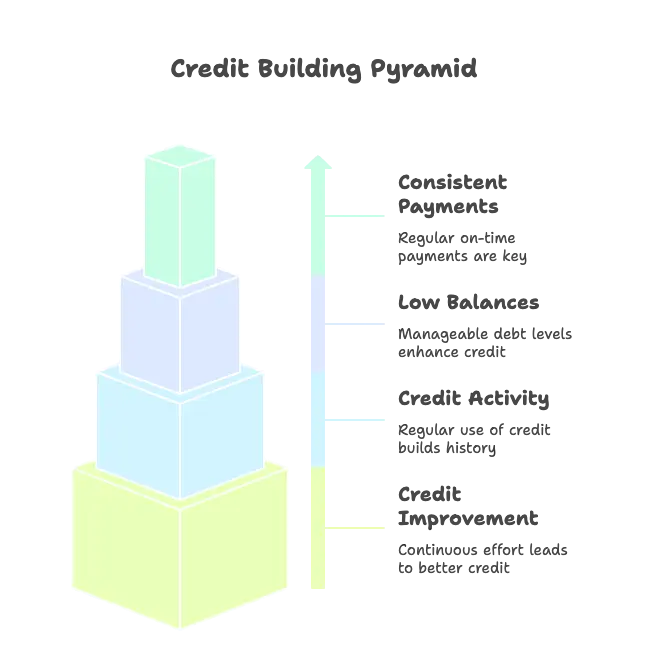

Credit building isn’t instant, but it’s also not endless. The timeline depends on consistency, not intensity. Understanding what progress actually looks like helps you stay patient and avoid self-sabotage.

Short-Term vs. Long-Term Expectations

In the short term, credit responds to behavioral changes, paying on time, lowering balances, stopping unnecessary applications. These can produce visible movement.

In the long term, credit rewards time and stability. Account age, long streaks of on-time payments, and restrained borrowing quietly strengthen your profile in ways no shortcut can replicate.

Think of momentum first. Maturity second.

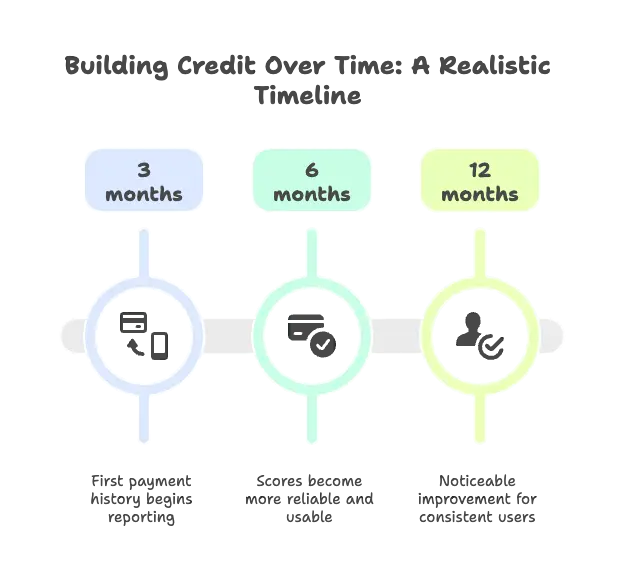

What Realistic Progress Looks Like

At 3 months

- First payment history begins reporting

- Small score movement is possible

- File starts to look active instead of empty

At 6 months

- Scores become more reliable and usable

- Better odds of approvals for entry-level products

- Early mistakes still matter, habits are critical

At 12 months

- Noticeable improvement for consistent users

- Access to better terms and unsecured options

- Credit shifts from fragile to functional

This timeline assumes on-time payments, low utilization, and no major missteps. Progress isn’t linear, but it is predictable.

Recommended Resources & Trusted Sources

When it comes to credit, credibility matters. These organizations provide reliable, consumer-focused education you can trust.

Consumer Financial Protection Bureau (CFPB)

- Clear, unbiased credit education

- Dispute guidance and consumer protections

- Practical tools and worksheets

Banks, Card Issuers, and Credit-Builder Programs

- Major banks offering secured cards

- Credit unions and community lenders

- Issuers with credit-builder loans and starter products

Use these for product education, not marketing promises.

Independent Financial Explainers

- Reputable personal finance publications

- Consumer-focused guides on building credit from scratch

- Non-affiliate educational resources

Cross-checking information keeps you grounded.

Final Thoughts: Credit Is a Skill, Not a Secret

Credit isn’t a mystery reserved for insiders. It’s a system that responds to behavior, slowly, consistently, and predictably.

Credit as a Long-Term Asset

Strong credit reduces costs, expands options, and creates flexibility. It works quietly in the background, but its impact compounds over time.

Consistency Over Hacks

There is no trick that beats paying on time, keeping balances low, and letting time work. The loudest strategies are often the weakest.

Encouragement for Beginners Starting Today

Everyone with great credit started where you are now. The difference wasn’t talent or income, it was starting, then staying consistent.

Build slowly. Stay patient. Credit will follow.

Leave a comment

Your email address will not be published. Required fields are marked *