When people ask whether a personal loan or a credit card costs less, they usually focus on one number: the APR. That instinct isn’t wrong, but it’s incomplete. The real comparison isn’t “loan vs card” in the abstract. It’s loan vs card for the same balance, carried over the same amount of time.

At a high level, the answer is surprisingly consistent: a personal loan usually costs less than a credit card when you’re carrying a balance for more than a few months. The reasons are structural, lower average rates, fixed terms, and payments that actually force progress. The exceptions matter, though. A 0% intro APR credit card, paid off before the promo ends, can beat any loan. And a high-APR personal loan can erase the usual advantage.

The deeper point: APR alone doesn’t tell the full story. How interest is applied, how payments are structured, and how long debt is allowed to linger often matter more than the headline rate. To understand which option truly costs less, you have to look at how each product works in real life.

How Each Product Charges Interest

Personal Loans: Fixed, Predictable Installment Debt

A personal loan is straightforward by design. You borrow a lump sum upfront, receive a fixed interest rate, and agree to a fixed repayment term, often anywhere from one to seven years.

Each month, you make the same payment, and that payment steadily chips away at both interest and principal. From day one, two things are locked in:

- Your monthly obligation

- Your payoff date

That structure makes personal loans predictable. You know exactly when the debt ends and how much it will cost if you stick to the schedule. There’s no minimum-payment illusion and no temptation to drag the balance forward indefinitely.

Credit Cards: Revolving, Variable, and Open-Ended

Credit cards work very differently. Instead of a lump sum, you get a credit limit you can borrow against repeatedly. Interest rates are usually variable, meaning they can rise over time, and repayment is open-ended.

Each month, the issuer requires only a minimum payment, often just a small percentage of the balance plus interest. Pay only that minimum, and the timeline stretches dramatically. The balance shrinks slowly, interest keeps accruing, and the total cost quietly balloons.

This is where compounding does its damage. When most of your payment goes toward interest, not principal, the debt lingers. Over time, even a modest balance can become expensive simply because it’s allowed to exist for too long.

Typical APRs: Personal Loans vs Credit Cards

Average Personal Loan APR Ranges

National averages

Across the U.S. market, unsecured personal loans tend to land in the low- to mid-teens for borrowers with decent credit. Recent nationwide averages hover around 12–13%, with the best-qualified borrowers seeing single-digit rates and weaker profiles pushed higher.

Credit-based rate variability

This is where loans get flexible, but also where risk shows up. Personal loan APRs typically range from under 6% at the low end to the mid-30% range for borrowers with poor credit. In other words, your credit profile largely determines whether a loan is a bargain or a borderline credit-card substitute.

Average Credit Card APR Ranges

Market averages

Credit cards occupy a much tighter, and much higher, band. Average APRs on new credit card offers now sit around the mid-20% range, and many mainstream cards cluster there regardless of issuer.

Why cards cluster in the low- to mid-20% range

Unlike loans, credit cards price in flexibility. The ability to borrow repeatedly, pay very little each month, and carry balances indefinitely comes at a cost. Issuers offset that risk with higher APRs, which is why even borrowers with solid credit rarely see card rates anywhere near personal-loan levels.

Why the APR Gap Matters Over Time

Same balance, radically different interest outcomes

A 10–12 percentage-point APR gap doesn’t sound dramatic, until time enters the equation. Over months and years, higher rates don’t just add cost; they slow progress. More of each payment goes to interest, less to principal, and the debt hangs around longer than most borrowers expect.

APR isn’t just a price tag. It’s a speed limiter on how fast your balance disappears.

Cost Example: Same Debt, Two Different Paths

Scenario Setup: One Balance, Two Products

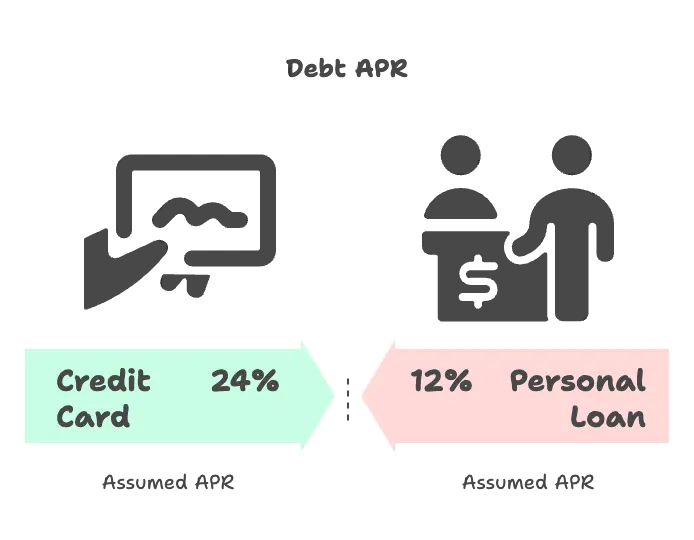

- Debt amount: $7,000

- Assumed APRs: Credit card: ~24%, Personal loan: ~12%

- Monthly payment: $250 in both cases

This keeps the comparison clean: same debt, same payment, different structure.

Credit Card Outcome

- Estimated payoff time: Roughly 40+ months if only consistent $250 payments are made

- Total interest paid: Well over $3,000

Why? Because a large chunk of each payment goes toward interest, especially in the early months. Progress is slow, and the balance lingers.

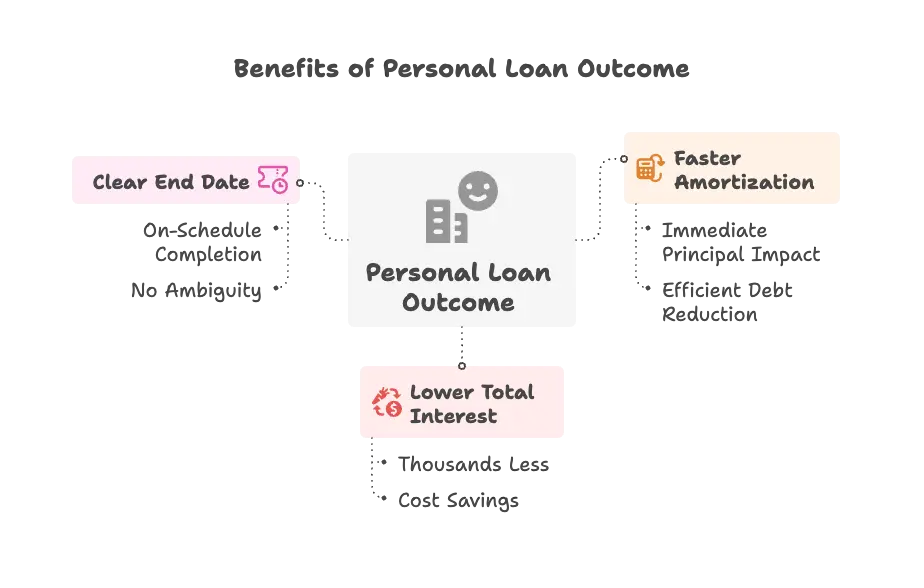

Personal Loan Outcome

- Faster amortization: More of each payment hits principal immediately

- Lower total interest: Thousands less over the life of the debt

- Clear end date: The loan ends on schedule, no ambiguity

With a fixed term and lower rate, the same $250 payment works harder from the very first month.

What This Example Teaches Borrowers

Why structure matters as much as rate

The lesson isn’t just “lower APR is better.” It’s that forced repayment beats flexibility when you’re carrying debt. Personal loans win not only because they’re cheaper, but because they don’t allow procrastination.

Credit cards give you options. Personal loans give you an exit.

When the goal is to eliminate debt, not manage it indefinitely, structure can be just as important as the number printed next to “APR.”

When a Personal Loan Usually Costs Less

A personal loan isn’t automatically cheaper, but in the right situations, it clearly wins on cost.

Good or excellent credit qualifications

If your credit is strong enough to qualify for a rate well below typical credit card APRs, a personal loan almost always comes out ahead. When you’re borrowing at low-to-mid-teens instead of the mid-20s, the math favors the loan quickly.

Large, one-time expenses

Personal loans are built for big, defined costs, medical bills, home repairs, relocation expenses. Because the amount is fixed and the term is set, you’re not tempted to keep re-borrowing the way you might with a credit card.

Debt consolidation use cases

Rolling multiple high-APR card balances into a single personal loan can sharply reduce interest costs while simplifying repayment. One payment, one payoff date, and no revolving balance hanging around in the background.

Protection from revolving minimum-payment traps

This is the quiet advantage. Personal loans don’t let you “coast.” Every payment reduces the balance, and the loan ends on schedule. For borrowers who tend to pay just above the minimum on cards, this structure alone can save thousands.

When a Credit Card Can Cost Less (or Nothing)

Despite their reputation, credit cards can be the cheapest option, if they’re used strategically.

0% Intro APR Opportunities

Purchase and balance-transfer promos

Many cards offer 0% intro APRs on purchases or balance transfers for 12 to 21 months. During that window, interest doesn’t accrue at all.

Importance of payoff timing

The catch is discipline. If the balance isn’t paid off before the promo ends, the remaining amount typically jumps to a high variable APR. Used correctly, these offers beat any loan. Used casually, they become expensive fast.

Paying the Balance in Full

Grace periods explained

Credit cards include a grace period that waives interest if you pay the full statement balance by the due date.

Why interest can be completely avoided

Carry no balance, pay no interest. In this scenario, a credit card isn’t just cheaper than a loan, it’s free borrowing, often with rewards layered on top.

Short-Term or Small Expenses

Convenience vs commitment trade-off

For expenses you can clear within a month or two, opening a personal loan can be overkill. A credit card offers speed, flexibility, and rewards without locking you into a multi-year commitment.

The key distinction isn’t the product, it’s behavior and timing. Credit cards reward short-term discipline. Personal loans protect against long-term drift.

Other Cost Factors Beyond APR

APR gets the spotlight, but it isn’t the only line item that matters. Fees, timelines, and credit mechanics can quietly tilt the cost equation in either direction.

Fees to Watch For

Personal loan fees

Personal loans often come with origination fees (typically 1%–8% of the loan), plus potential late fees and, in rare cases, prepayment penalties. A low APR can lose some of its advantage if upfront fees are high, especially on smaller loans.

Credit card fees

Credit cards bring their own set of costs: annual fees, balance transfer fees, cash-advance fees, and foreign transaction fees. While many cards waive annual fees, balance transfers commonly cost 3%–5%, which can rival a loan’s origination fee if you’re moving a large balance.

Term Length and Total Interest

Low APR ≠ low total cost if the term is long

A personal loan with a modest APR stretched over five or seven years can still rack up meaningful interest. Meanwhile, a higher-APR credit card aggressively paid down in a short window may cost less overall. The timeline matters as much as the rate.

Credit Score Impact

Utilization effects

Credit cards directly affect your utilization ratio. High balances relative to your limit can drag scores down, even if you’re paying on time. Personal loans don’t count toward revolving utilization, which can be a relief for credit scores under pressure.

Credit mix considerations

Installment loans add diversity to your credit profile, which can help scores over time. That said, opening any new account triggers a hard inquiry, so timing and necessity still matter.

Final Verdict: Personal Loan vs Credit Card , Which One Really Costs Less?

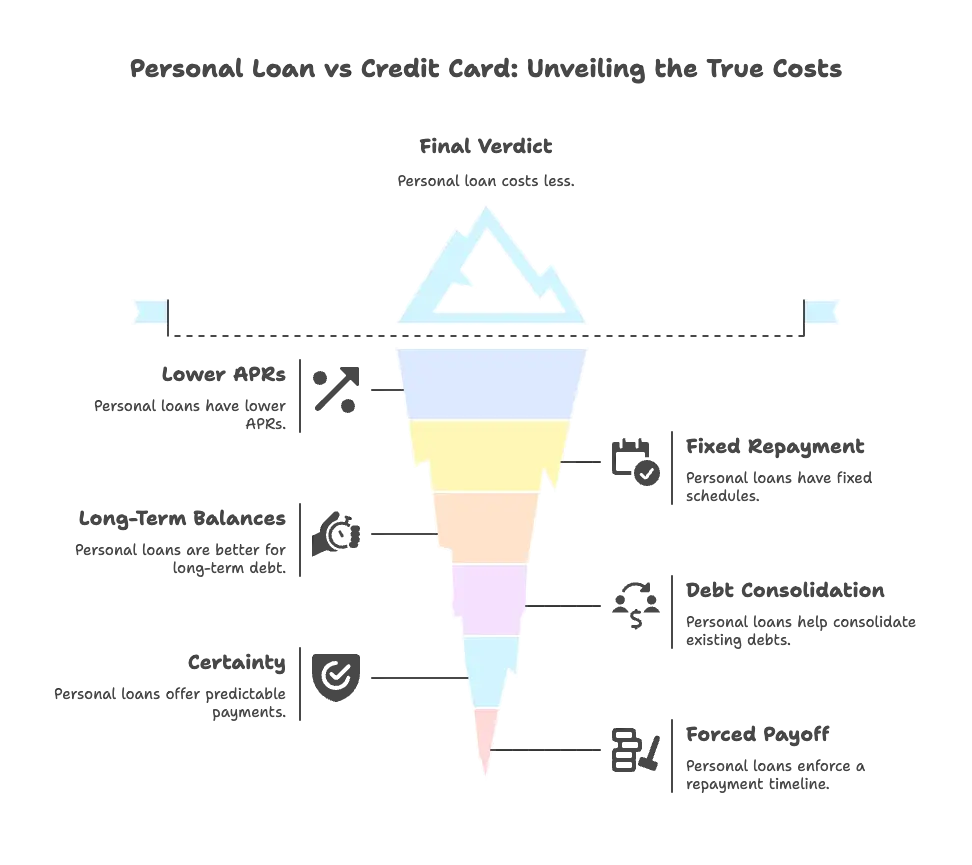

The short answer:

For most people carrying a balance over many months, a reasonably priced personal loan costs less than a credit card. Lower average APRs and fixed repayment schedules do the heavy lifting.

When each wins:

- Personal loans win for long-term balances, debt consolidation, and borrowers who want certainty and a forced payoff timeline.

- Credit cards win for short-term spending, disciplined payoff, and 0% intro APR strategies executed correctly.

The real deciding factors:

Not the product, but behavior, payoff timeline, and credit profile. Credit cards reward precision and discipline. Personal loans protect against drift and indecision.